December 3, 2024

Charges via WhatsApp: how does this practice work?

Learn about the risks and limits of this type of communication.

December 3, 2024

Charges via WhatsApp: how does this practice work?

Learn about the risks and limits of this type of communication.

December 3, 2024

Charges via WhatsApp: how does this practice work?

Learn about the risks and limits of this type of communication.

Since 2013, the Consumer Defense Institute (IDEC) has allowed the collection of overdue payments to be made through social media, and WhatsApp fits this case, becoming one of the main platforms to contact people in this context.

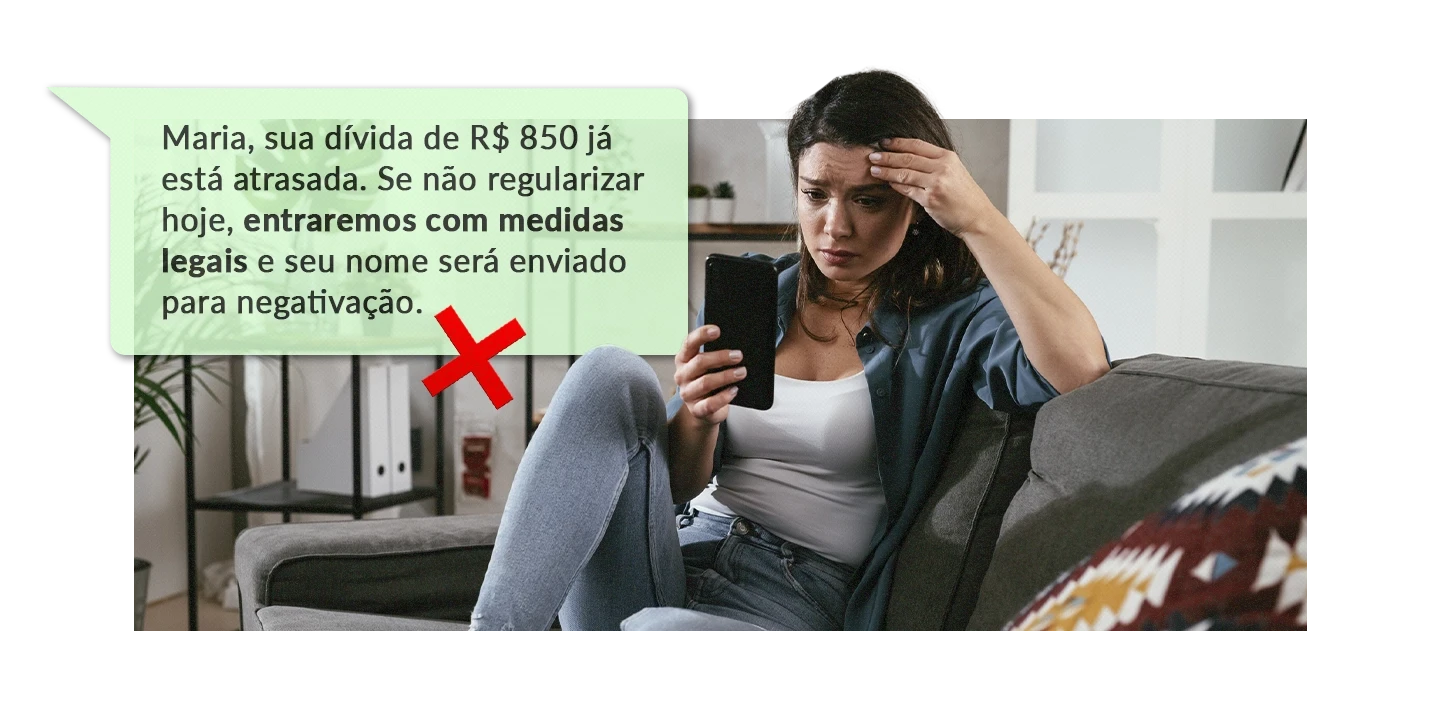

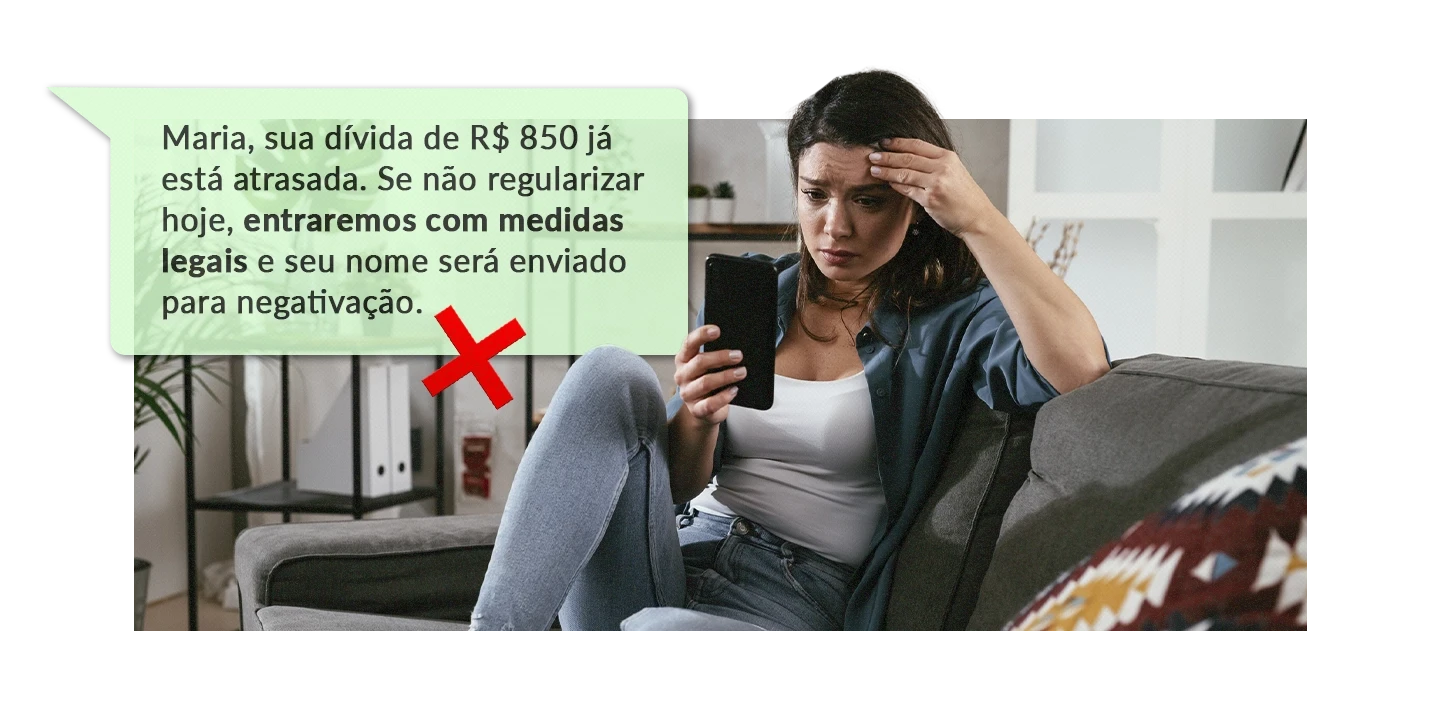

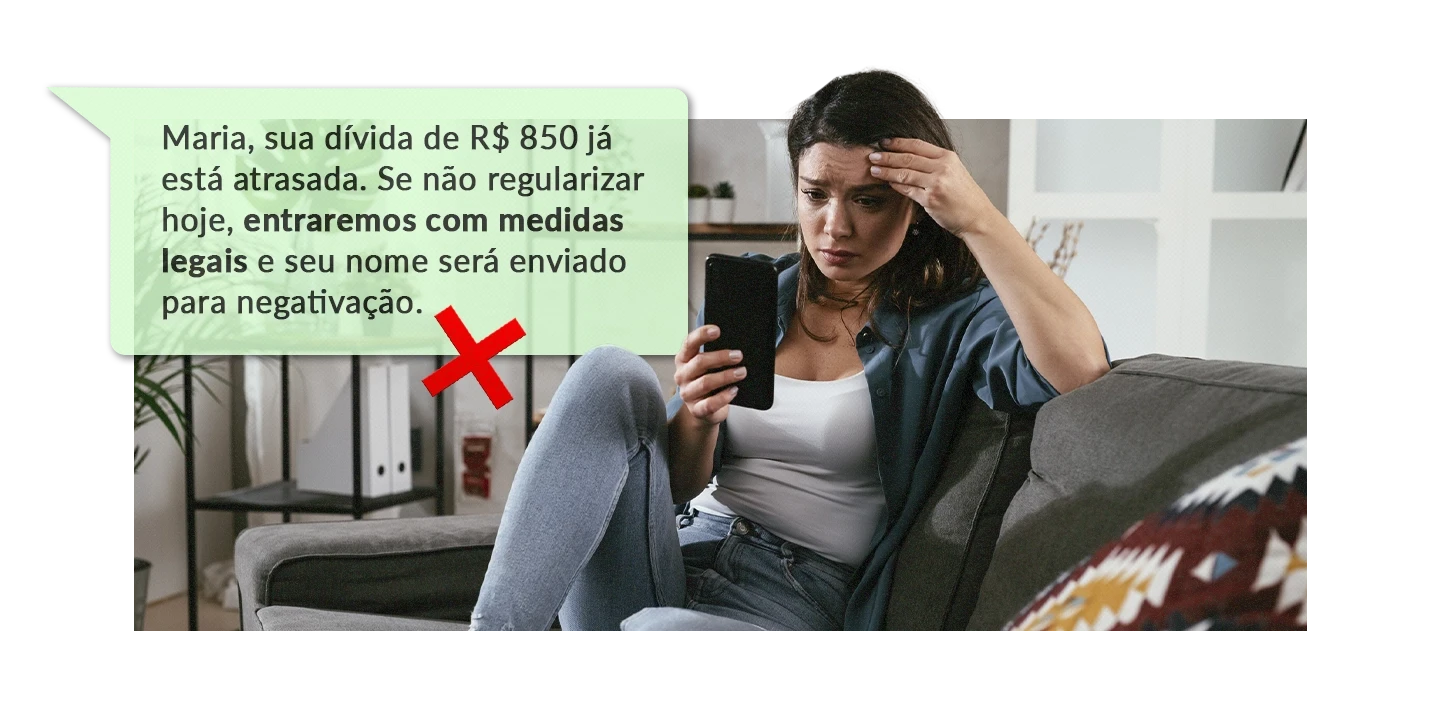

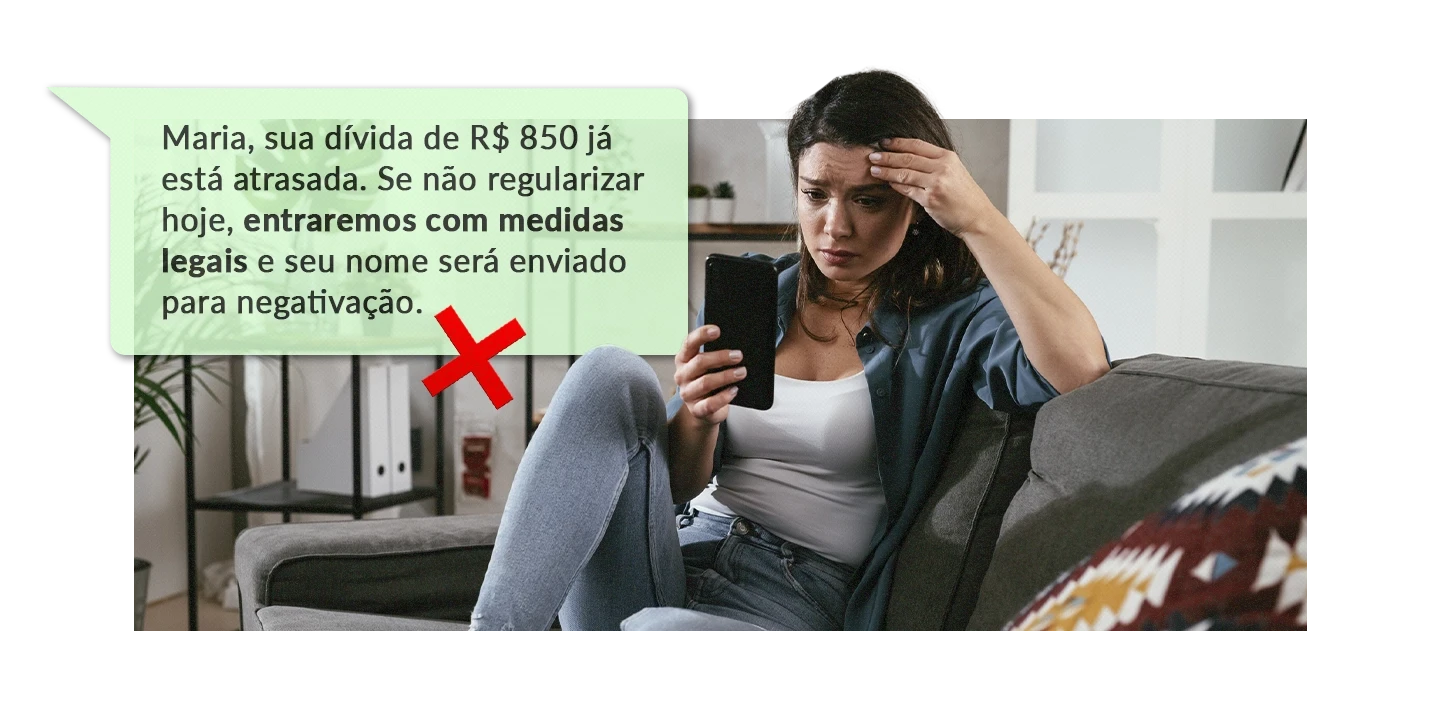

Although it is a legal operation, some debt recovery agencies and banks that usually operate via WhatsApp still make mistakes in their approach to clients, resulting in embarrassing situations and violations of privacy.

Also read: Transparency in the treatment of customers' personal data

Collections are always very delicate, and the way they are made can be decisive in retaining or losing account holders and clients. Therefore, we have prepared a practical guide with tips on best practices and guidelines on procedures to avoid.

Let’s check it out!

What to do and what to avoid in collections via WhatsApp

Phone calls with the purpose of collecting overdue payments are so unwanted by clients that, to avoid interaction with companies, people end up blocking calls from unknown numbers on their smartphones.

What no one anticipated, however, is that debt recovery agencies and banks, unable to talk to their clients via cell phone, would resort to WhatsApp to locate defaulters and renegotiate debts.

Also read: WhatsApp in companies: how to formalize?

The strategy makes perfect sense, as the app is present on 99% of smartphones in the Brazilian population and most communications happen on this platform.

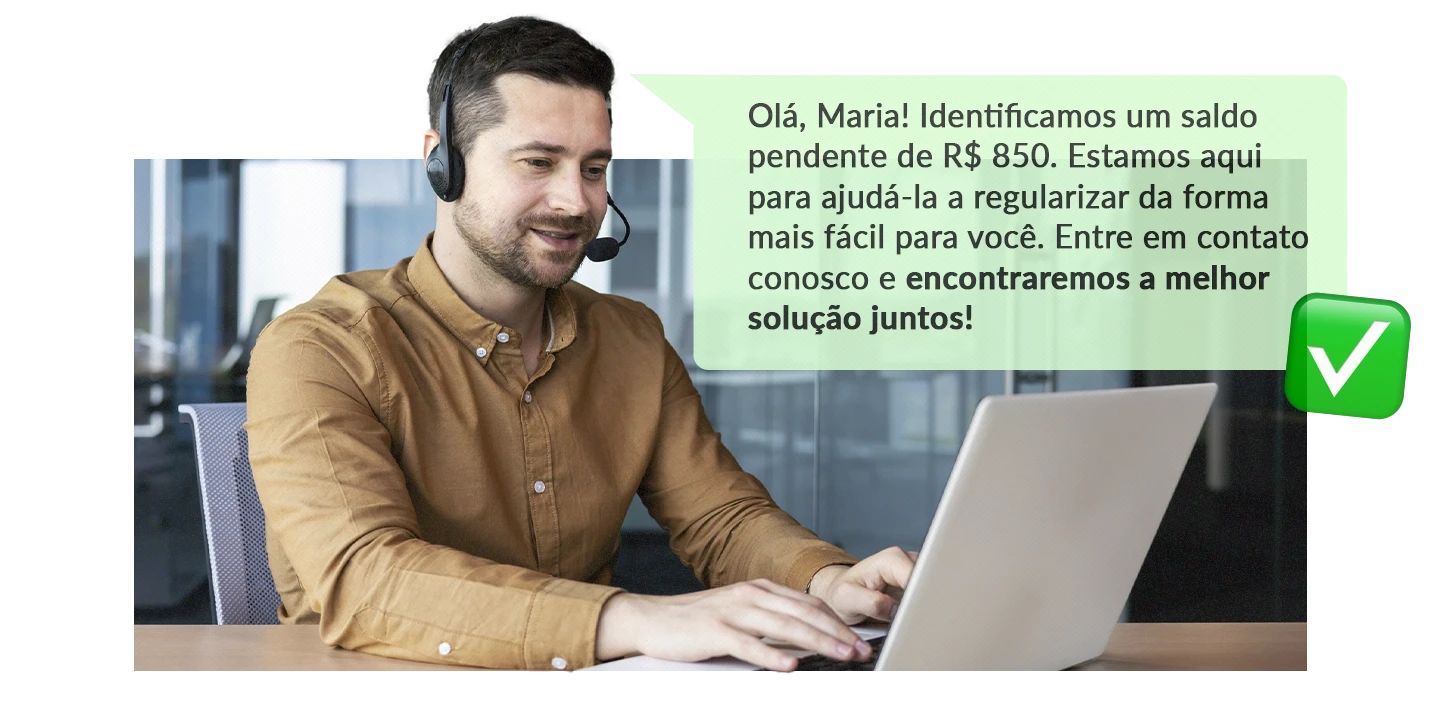

However, despite the informality of the app, discussing financial issues with clients via WhatsApp requires techniques from attendants, ranging from a cordial demeanor during the conversation to the handling of the client's data at the end of the contact.

Check out other important points in this process:

Respect the Consumer Defense Code;

Obtain the client's consent for making contact;

Avoid disturbances. Messages should respect business days and hours;

Do not send persistent messages several times a day;

Do not send messages to unknown numbers not provided by the client;

Verify the debtor's identity before mentioning the reason for contact;

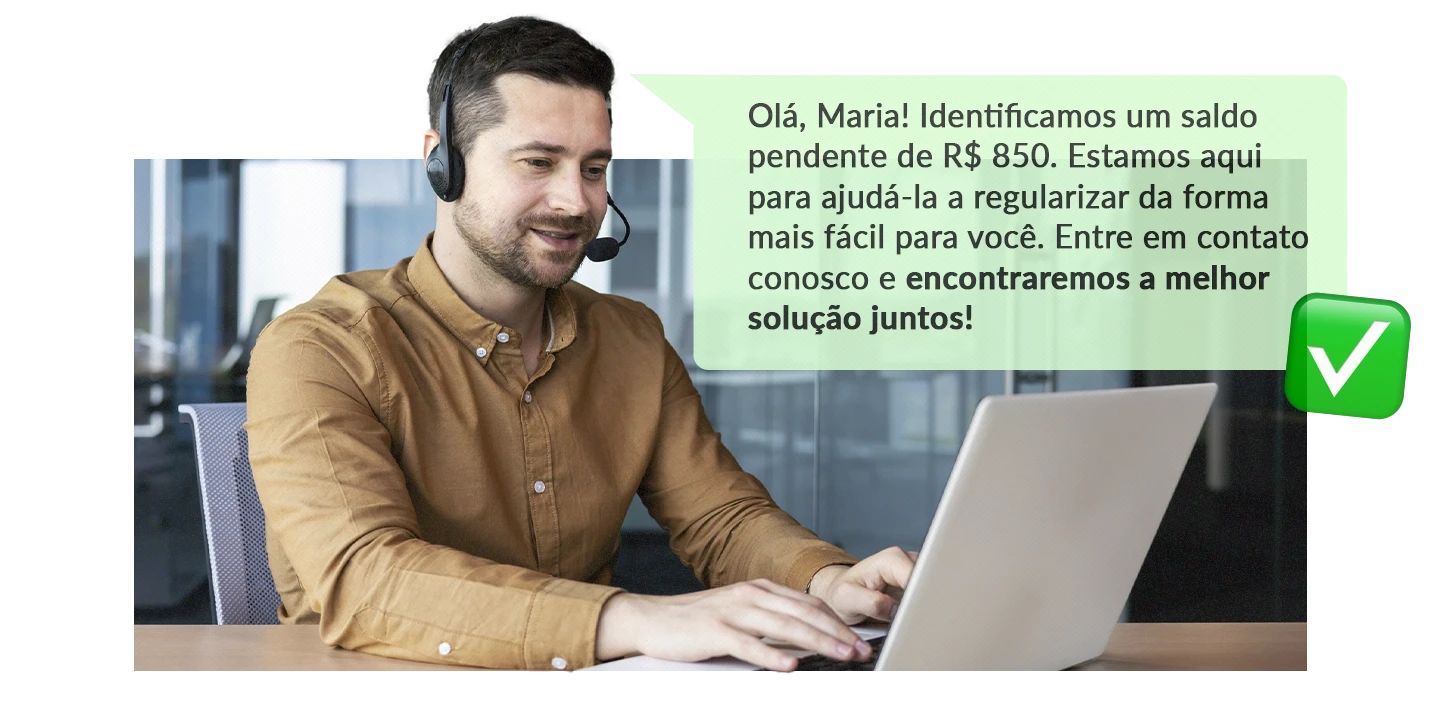

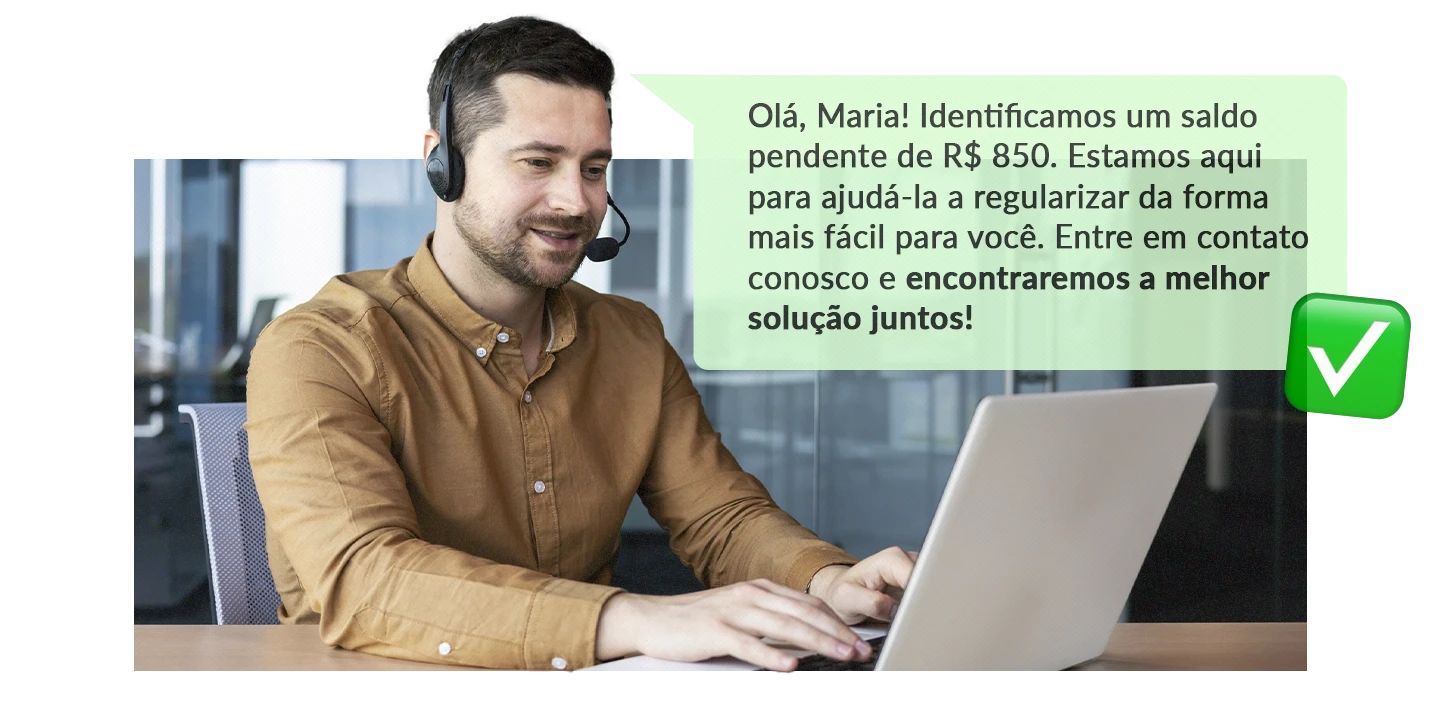

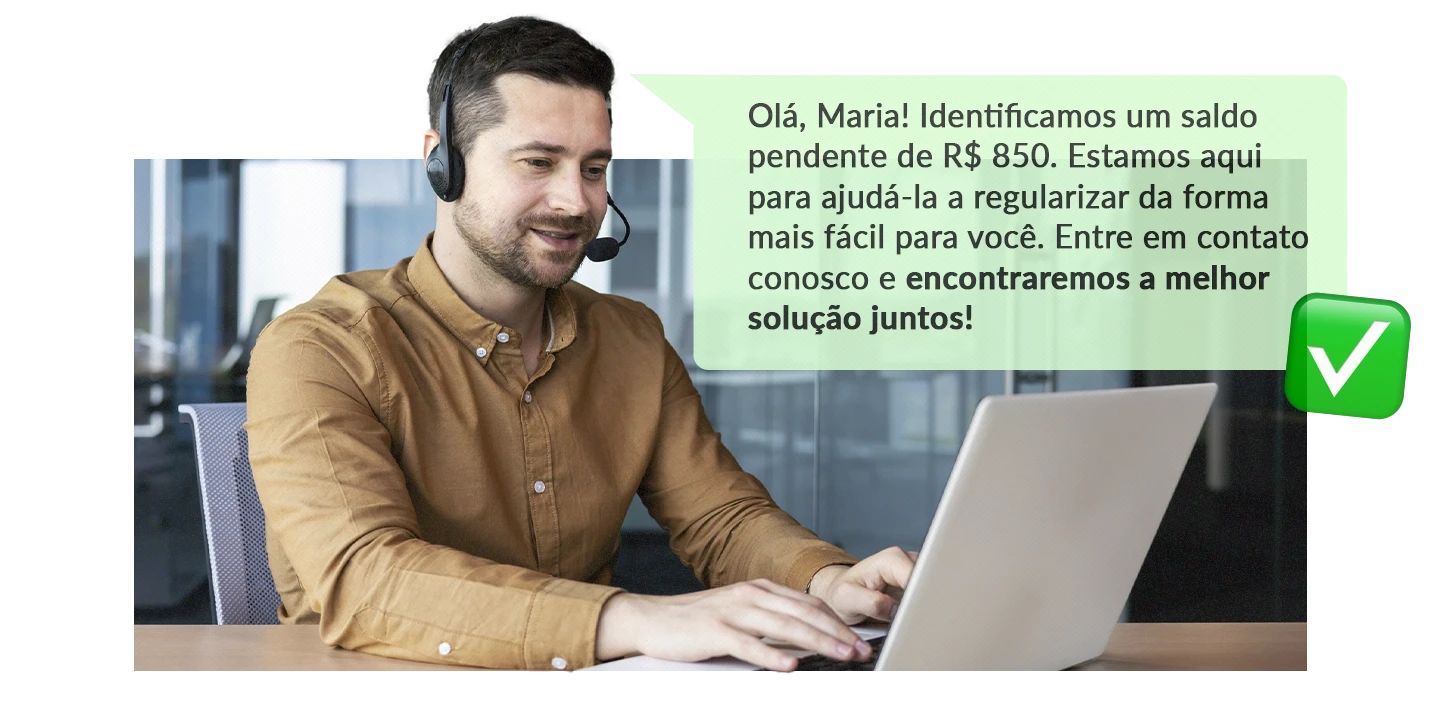

Be objective and respectful, offering friendly solutions, such as discounts, payment plans, etc.;

It is worth noting that despite the debt, the client is the element in the interaction with the greatest power of choice in this case. If any of the points are not followed during the dialogue, the risk of the company's WhatsApp number being blocked and reported is quite high, making it difficult for the company to make a new approach.

How to ensure ethics and compliance with policies in financial collections via WhatsApp?

The implementation of financial collection via WhatsApp, whether in a bank, in a company's billing department, or in a debt recovery agency, requires training on processes, customer service techniques, crisis management, and monitoring of interactions.

Also read: Main doubts about monitoring corporate WhatsApp

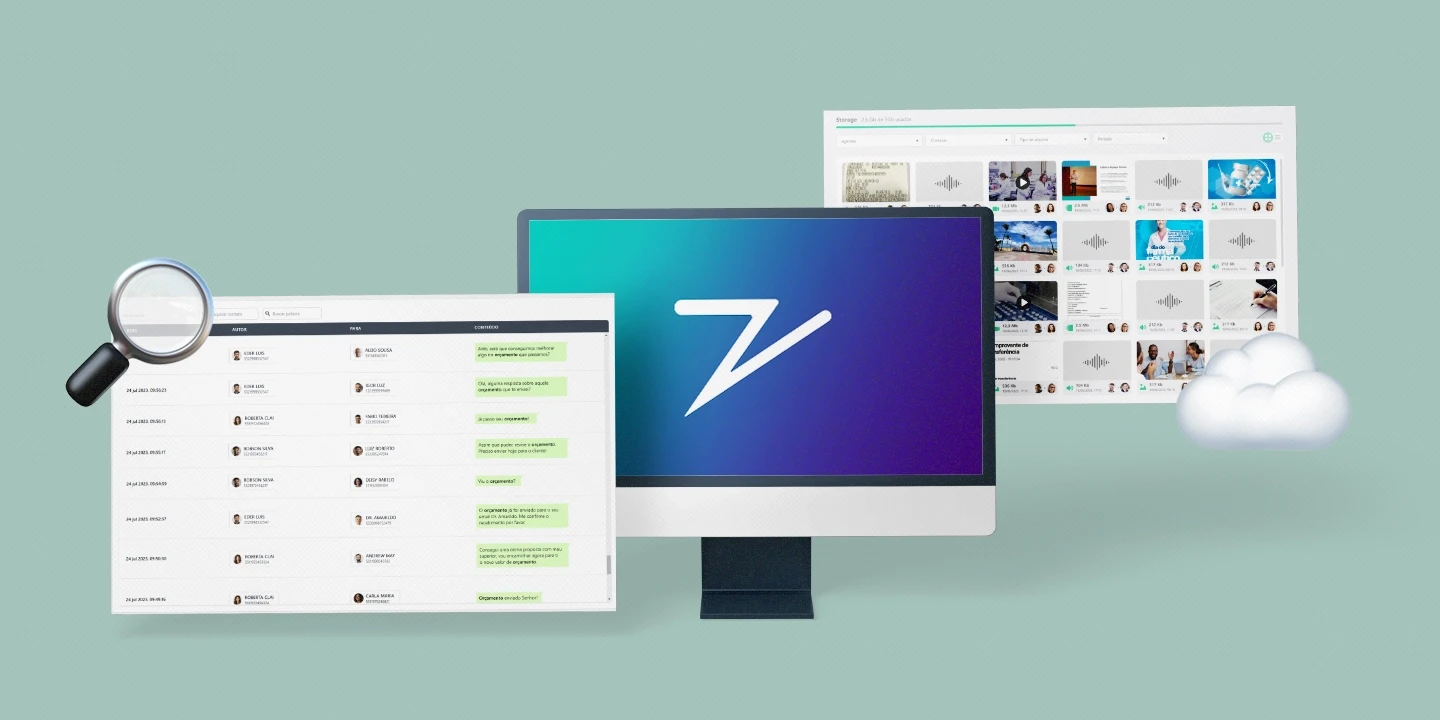

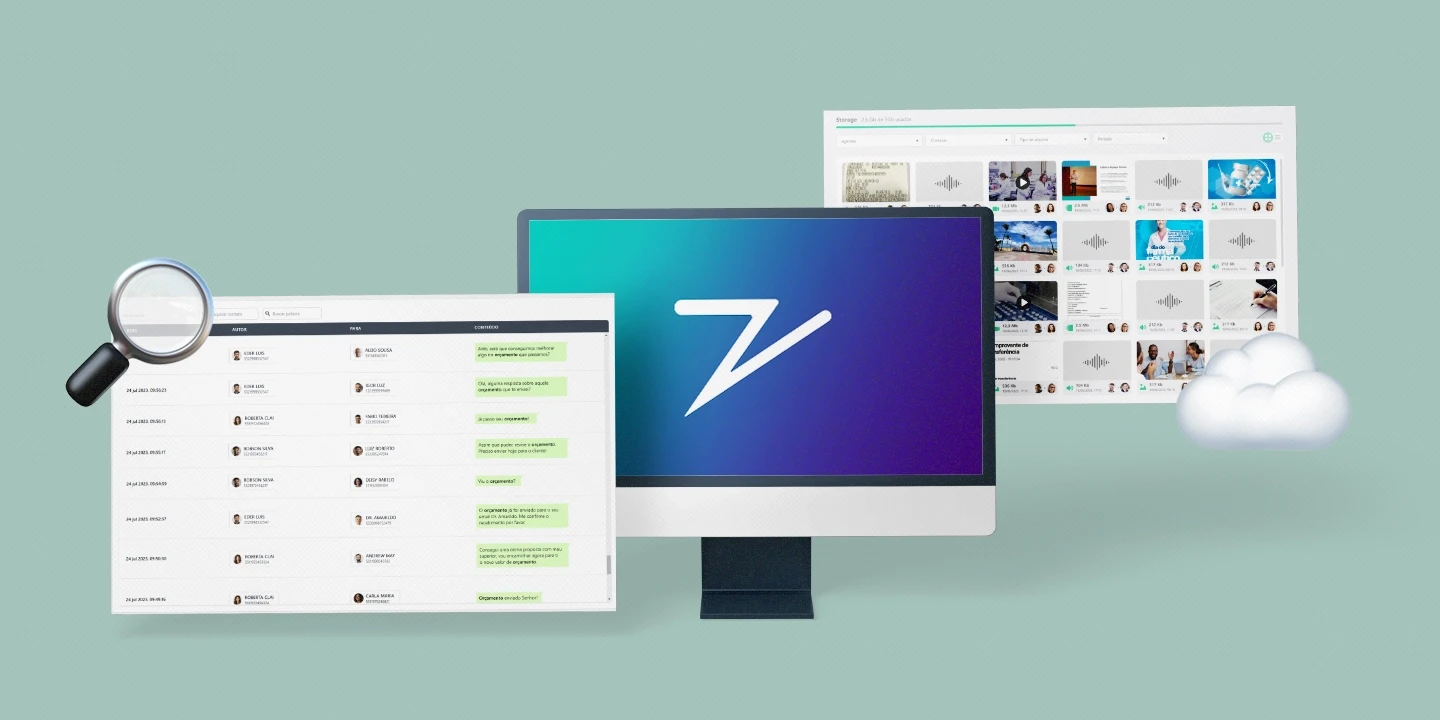

To ensure that the organization's rules are followed, check the performance of attendants and identify suspicious conversations, monitoring with Zapper is essential.

Zapper is the first monitoring tool for corporate WhatsApp conversations in Latin America, created to enable digital communication governance for organizations.

The solution tracks and records all interactions on the company's WhatsApp and automatically saves conversations in their entirety, in the cloud, for unlimited time. In this way, the sensitive contents addressed in conversations, such as personal data and banking information, are kept in maximum security, avoiding leaks.

And thanks to the conversational intelligence applied to Zapper, monitoring dialogues allows for the identification of suspicious dialogues through keywords. As these registered terms appear, a notification is sent to the manager, who can intervene immediately.

Also read: How to apply Conversational Intelligence to corporate WhatsApp

Monitoring identifies situations such as embarrassment, use of inappropriate language, lack of decorum, illicit favoritism, fraud, among others, raising the quality of service and allowing clients to perceive greater trust from the company.

Discover how Zapper can make a difference in your business and in client retention!

Click here to schedule a demonstration of the tool.

Since 2013, the Consumer Defense Institute (IDEC) has allowed the collection of overdue payments to be made through social media, and WhatsApp fits this case, becoming one of the main platforms to contact people in this context.

Although it is a legal operation, some debt recovery agencies and banks that usually operate via WhatsApp still make mistakes in their approach to clients, resulting in embarrassing situations and violations of privacy.

Also read: Transparency in the treatment of customers' personal data

Collections are always very delicate, and the way they are made can be decisive in retaining or losing account holders and clients. Therefore, we have prepared a practical guide with tips on best practices and guidelines on procedures to avoid.

Let’s check it out!

What to do and what to avoid in collections via WhatsApp

Phone calls with the purpose of collecting overdue payments are so unwanted by clients that, to avoid interaction with companies, people end up blocking calls from unknown numbers on their smartphones.

What no one anticipated, however, is that debt recovery agencies and banks, unable to talk to their clients via cell phone, would resort to WhatsApp to locate defaulters and renegotiate debts.

Also read: WhatsApp in companies: how to formalize?

The strategy makes perfect sense, as the app is present on 99% of smartphones in the Brazilian population and most communications happen on this platform.

However, despite the informality of the app, discussing financial issues with clients via WhatsApp requires techniques from attendants, ranging from a cordial demeanor during the conversation to the handling of the client's data at the end of the contact.

Check out other important points in this process:

Respect the Consumer Defense Code;

Obtain the client's consent for making contact;

Avoid disturbances. Messages should respect business days and hours;

Do not send persistent messages several times a day;

Do not send messages to unknown numbers not provided by the client;

Verify the debtor's identity before mentioning the reason for contact;

Be objective and respectful, offering friendly solutions, such as discounts, payment plans, etc.;

It is worth noting that despite the debt, the client is the element in the interaction with the greatest power of choice in this case. If any of the points are not followed during the dialogue, the risk of the company's WhatsApp number being blocked and reported is quite high, making it difficult for the company to make a new approach.

How to ensure ethics and compliance with policies in financial collections via WhatsApp?

The implementation of financial collection via WhatsApp, whether in a bank, in a company's billing department, or in a debt recovery agency, requires training on processes, customer service techniques, crisis management, and monitoring of interactions.

Also read: Main doubts about monitoring corporate WhatsApp

To ensure that the organization's rules are followed, check the performance of attendants and identify suspicious conversations, monitoring with Zapper is essential.

Zapper is the first monitoring tool for corporate WhatsApp conversations in Latin America, created to enable digital communication governance for organizations.

The solution tracks and records all interactions on the company's WhatsApp and automatically saves conversations in their entirety, in the cloud, for unlimited time. In this way, the sensitive contents addressed in conversations, such as personal data and banking information, are kept in maximum security, avoiding leaks.

And thanks to the conversational intelligence applied to Zapper, monitoring dialogues allows for the identification of suspicious dialogues through keywords. As these registered terms appear, a notification is sent to the manager, who can intervene immediately.

Also read: How to apply Conversational Intelligence to corporate WhatsApp

Monitoring identifies situations such as embarrassment, use of inappropriate language, lack of decorum, illicit favoritism, fraud, among others, raising the quality of service and allowing clients to perceive greater trust from the company.

Discover how Zapper can make a difference in your business and in client retention!

Click here to schedule a demonstration of the tool.

Since 2013, the Consumer Defense Institute (IDEC) has allowed the collection of overdue payments to be made through social media, and WhatsApp fits this case, becoming one of the main platforms to contact people in this context.

Although it is a legal operation, some debt recovery agencies and banks that usually operate via WhatsApp still make mistakes in their approach to clients, resulting in embarrassing situations and violations of privacy.

Also read: Transparency in the treatment of customers' personal data

Collections are always very delicate, and the way they are made can be decisive in retaining or losing account holders and clients. Therefore, we have prepared a practical guide with tips on best practices and guidelines on procedures to avoid.

Let’s check it out!

What to do and what to avoid in collections via WhatsApp

Phone calls with the purpose of collecting overdue payments are so unwanted by clients that, to avoid interaction with companies, people end up blocking calls from unknown numbers on their smartphones.

What no one anticipated, however, is that debt recovery agencies and banks, unable to talk to their clients via cell phone, would resort to WhatsApp to locate defaulters and renegotiate debts.

Also read: WhatsApp in companies: how to formalize?

The strategy makes perfect sense, as the app is present on 99% of smartphones in the Brazilian population and most communications happen on this platform.

However, despite the informality of the app, discussing financial issues with clients via WhatsApp requires techniques from attendants, ranging from a cordial demeanor during the conversation to the handling of the client's data at the end of the contact.

Check out other important points in this process:

Respect the Consumer Defense Code;

Obtain the client's consent for making contact;

Avoid disturbances. Messages should respect business days and hours;

Do not send persistent messages several times a day;

Do not send messages to unknown numbers not provided by the client;

Verify the debtor's identity before mentioning the reason for contact;

Be objective and respectful, offering friendly solutions, such as discounts, payment plans, etc.;

It is worth noting that despite the debt, the client is the element in the interaction with the greatest power of choice in this case. If any of the points are not followed during the dialogue, the risk of the company's WhatsApp number being blocked and reported is quite high, making it difficult for the company to make a new approach.

How to ensure ethics and compliance with policies in financial collections via WhatsApp?

The implementation of financial collection via WhatsApp, whether in a bank, in a company's billing department, or in a debt recovery agency, requires training on processes, customer service techniques, crisis management, and monitoring of interactions.

Also read: Main doubts about monitoring corporate WhatsApp

To ensure that the organization's rules are followed, check the performance of attendants and identify suspicious conversations, monitoring with Zapper is essential.

Zapper is the first monitoring tool for corporate WhatsApp conversations in Latin America, created to enable digital communication governance for organizations.

The solution tracks and records all interactions on the company's WhatsApp and automatically saves conversations in their entirety, in the cloud, for unlimited time. In this way, the sensitive contents addressed in conversations, such as personal data and banking information, are kept in maximum security, avoiding leaks.

And thanks to the conversational intelligence applied to Zapper, monitoring dialogues allows for the identification of suspicious dialogues through keywords. As these registered terms appear, a notification is sent to the manager, who can intervene immediately.

Also read: How to apply Conversational Intelligence to corporate WhatsApp

Monitoring identifies situations such as embarrassment, use of inappropriate language, lack of decorum, illicit favoritism, fraud, among others, raising the quality of service and allowing clients to perceive greater trust from the company.

Discover how Zapper can make a difference in your business and in client retention!

Click here to schedule a demonstration of the tool.

Since 2013, the Consumer Defense Institute (IDEC) has allowed the collection of overdue payments to be made through social media, and WhatsApp fits this case, becoming one of the main platforms to contact people in this context.

Although it is a legal operation, some debt recovery agencies and banks that usually operate via WhatsApp still make mistakes in their approach to clients, resulting in embarrassing situations and violations of privacy.

Also read: Transparency in the treatment of customers' personal data

Collections are always very delicate, and the way they are made can be decisive in retaining or losing account holders and clients. Therefore, we have prepared a practical guide with tips on best practices and guidelines on procedures to avoid.

Let’s check it out!

What to do and what to avoid in collections via WhatsApp

Phone calls with the purpose of collecting overdue payments are so unwanted by clients that, to avoid interaction with companies, people end up blocking calls from unknown numbers on their smartphones.

What no one anticipated, however, is that debt recovery agencies and banks, unable to talk to their clients via cell phone, would resort to WhatsApp to locate defaulters and renegotiate debts.

Also read: WhatsApp in companies: how to formalize?

The strategy makes perfect sense, as the app is present on 99% of smartphones in the Brazilian population and most communications happen on this platform.

However, despite the informality of the app, discussing financial issues with clients via WhatsApp requires techniques from attendants, ranging from a cordial demeanor during the conversation to the handling of the client's data at the end of the contact.

Check out other important points in this process:

Respect the Consumer Defense Code;

Obtain the client's consent for making contact;

Avoid disturbances. Messages should respect business days and hours;

Do not send persistent messages several times a day;

Do not send messages to unknown numbers not provided by the client;

Verify the debtor's identity before mentioning the reason for contact;

Be objective and respectful, offering friendly solutions, such as discounts, payment plans, etc.;

It is worth noting that despite the debt, the client is the element in the interaction with the greatest power of choice in this case. If any of the points are not followed during the dialogue, the risk of the company's WhatsApp number being blocked and reported is quite high, making it difficult for the company to make a new approach.

How to ensure ethics and compliance with policies in financial collections via WhatsApp?

The implementation of financial collection via WhatsApp, whether in a bank, in a company's billing department, or in a debt recovery agency, requires training on processes, customer service techniques, crisis management, and monitoring of interactions.

Also read: Main doubts about monitoring corporate WhatsApp

To ensure that the organization's rules are followed, check the performance of attendants and identify suspicious conversations, monitoring with Zapper is essential.

Zapper is the first monitoring tool for corporate WhatsApp conversations in Latin America, created to enable digital communication governance for organizations.

The solution tracks and records all interactions on the company's WhatsApp and automatically saves conversations in their entirety, in the cloud, for unlimited time. In this way, the sensitive contents addressed in conversations, such as personal data and banking information, are kept in maximum security, avoiding leaks.

And thanks to the conversational intelligence applied to Zapper, monitoring dialogues allows for the identification of suspicious dialogues through keywords. As these registered terms appear, a notification is sent to the manager, who can intervene immediately.

Also read: How to apply Conversational Intelligence to corporate WhatsApp

Monitoring identifies situations such as embarrassment, use of inappropriate language, lack of decorum, illicit favoritism, fraud, among others, raising the quality of service and allowing clients to perceive greater trust from the company.

Discover how Zapper can make a difference in your business and in client retention!

Click here to schedule a demonstration of the tool.

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Share:

Share:

Share:

Share: