January 7, 2025

WhatsApp and Pix: the revolution of instant transfers

The most popular messaging app in Brazil can be integrated with the payment system preferred by Brazilians.

January 7, 2025

WhatsApp and Pix: the revolution of instant transfers

The most popular messaging app in Brazil can be integrated with the payment system preferred by Brazilians.

January 7, 2025

WhatsApp and Pix: the revolution of instant transfers

The most popular messaging app in Brazil can be integrated with the payment system preferred by Brazilians.

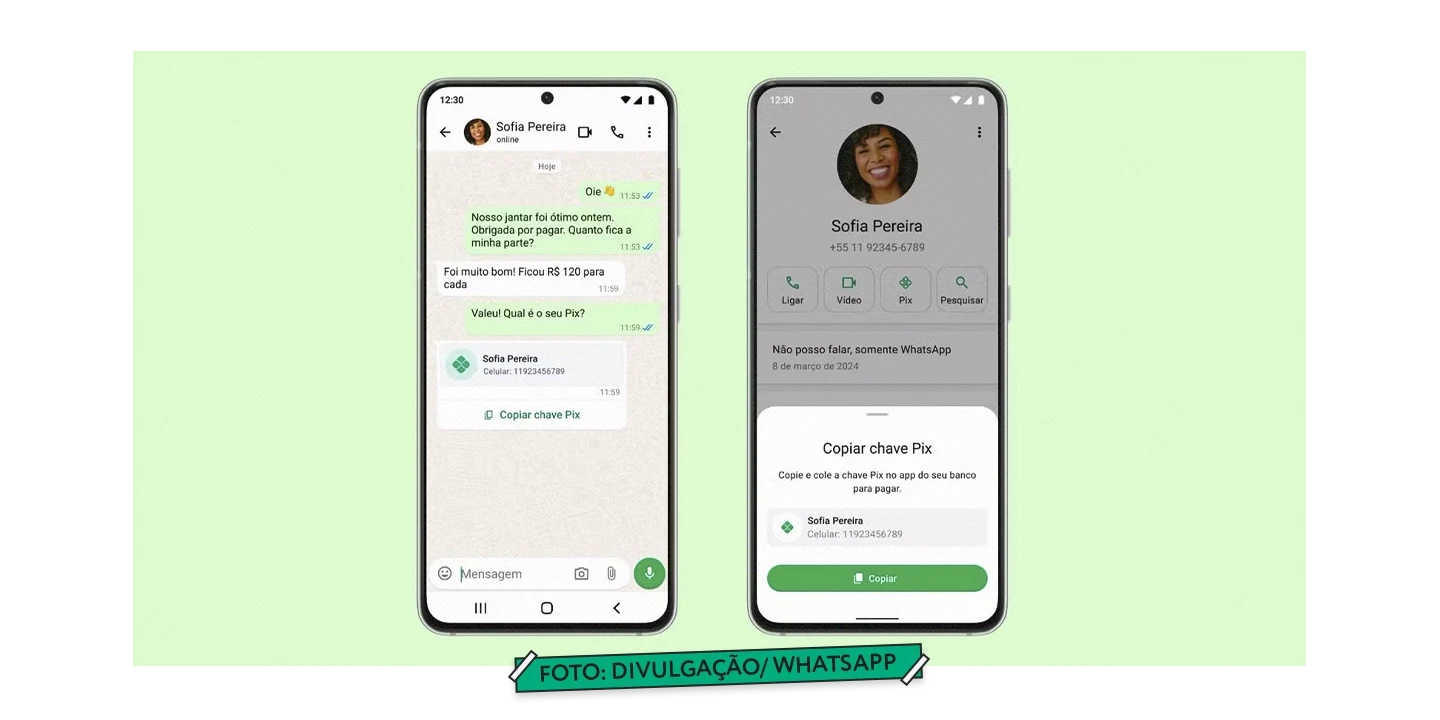

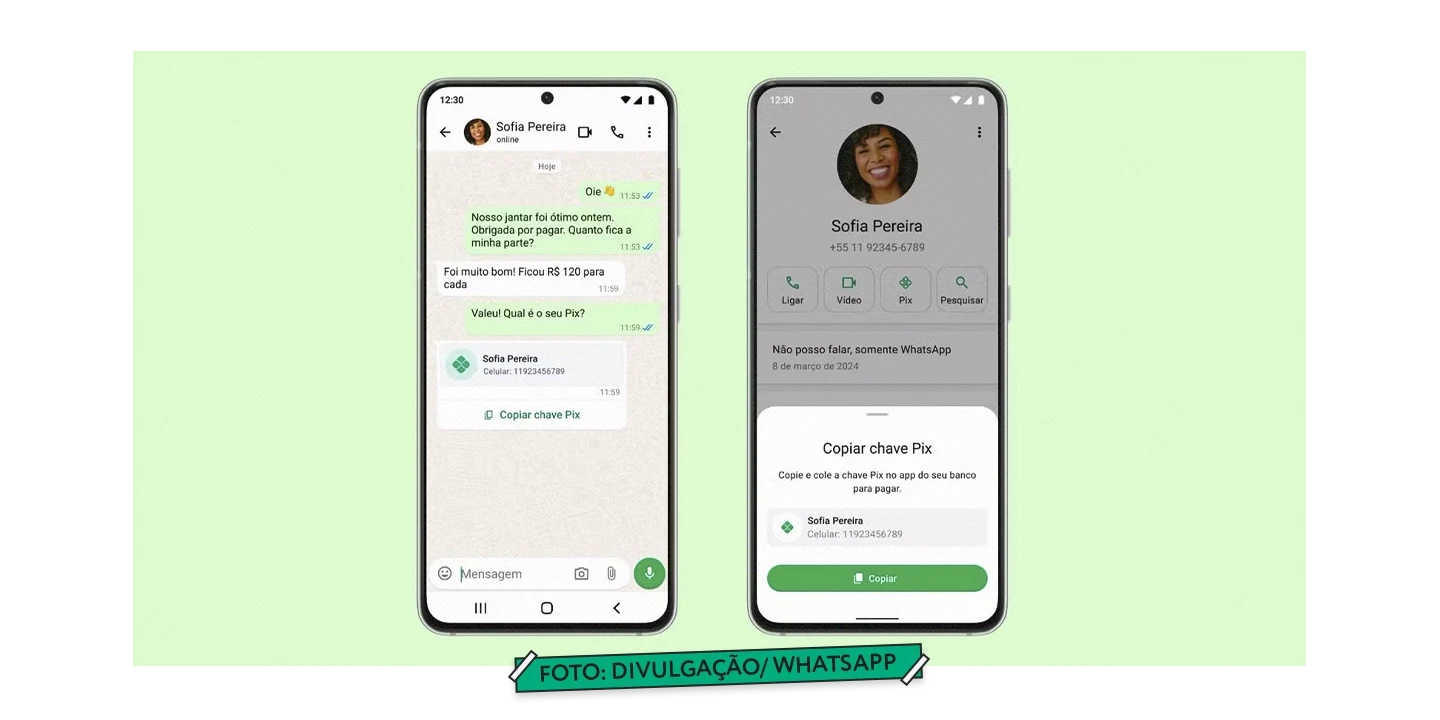

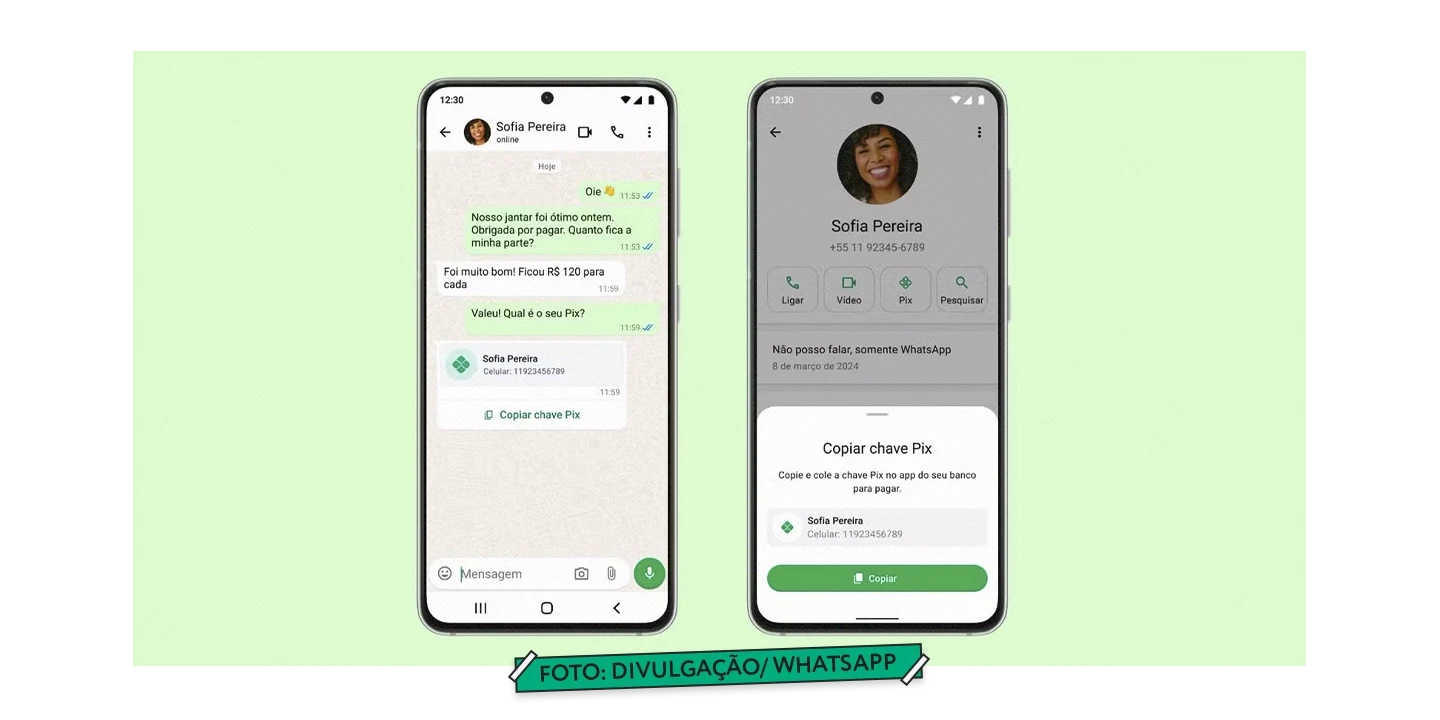

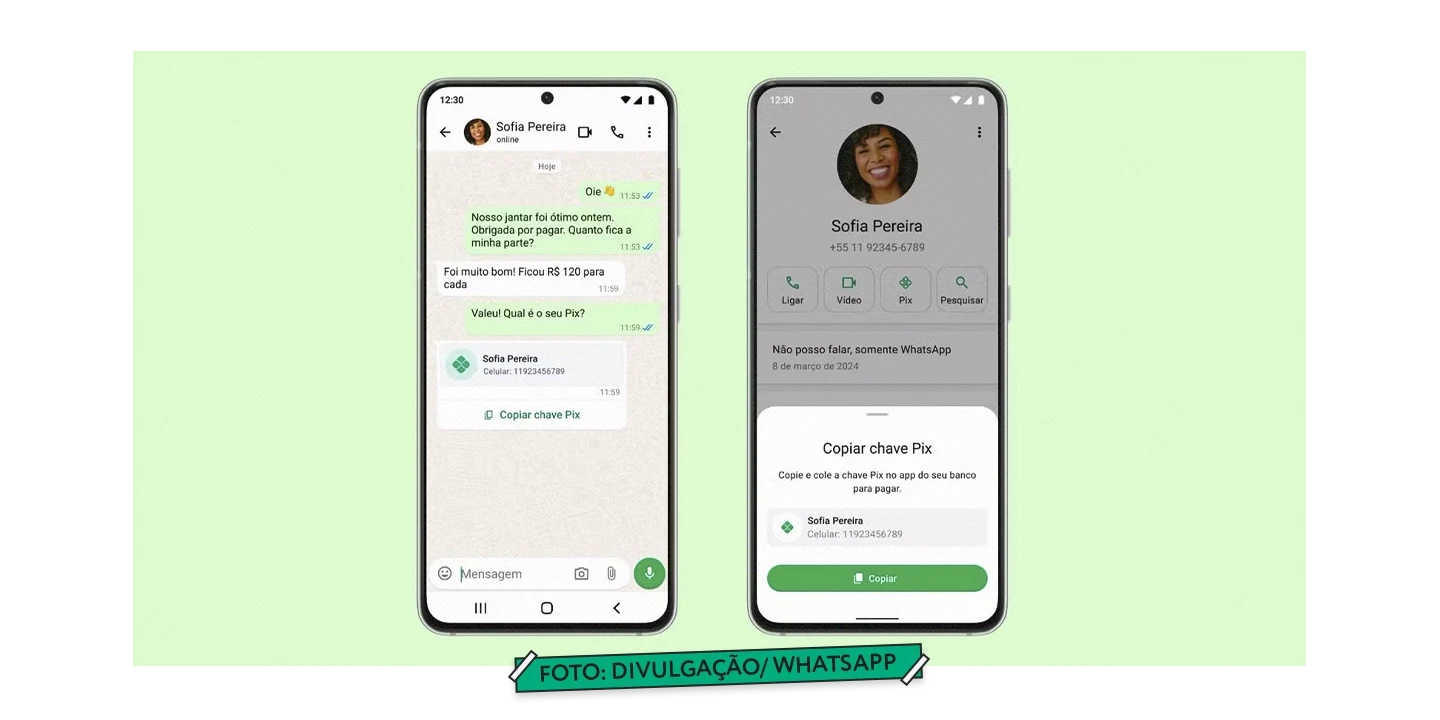

The WhatsApp never tires of reinventing and evolving its features. On the eve of 2024, Meta announced a new feature to facilitate financial transactions through the app, using a new resource: a shortcut for the Pix key.

This is just the beginning of an integration that may deepen in 2025. The initial idea is to replace debit card payments between individuals within the application. The feature, which will be available by the end of January for all users, will allow the display of Pix keys in the user's profile.

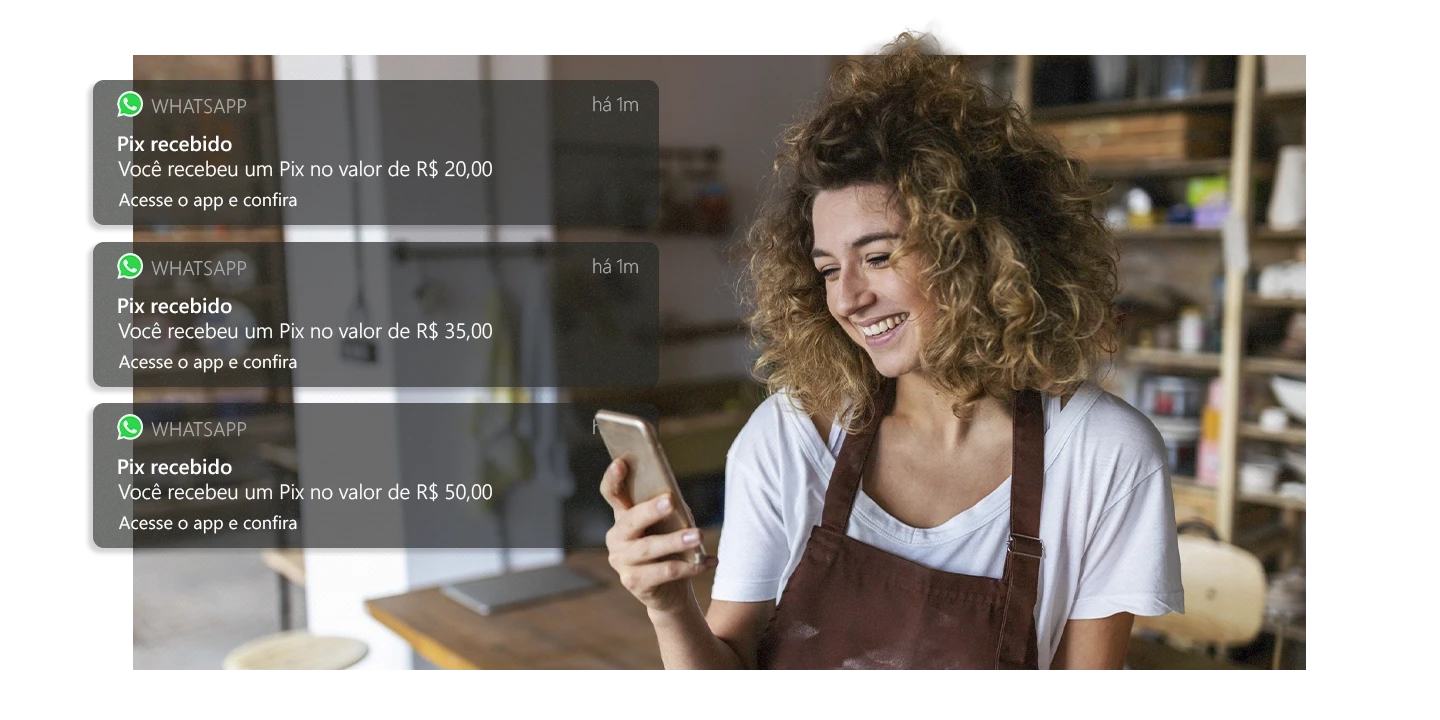

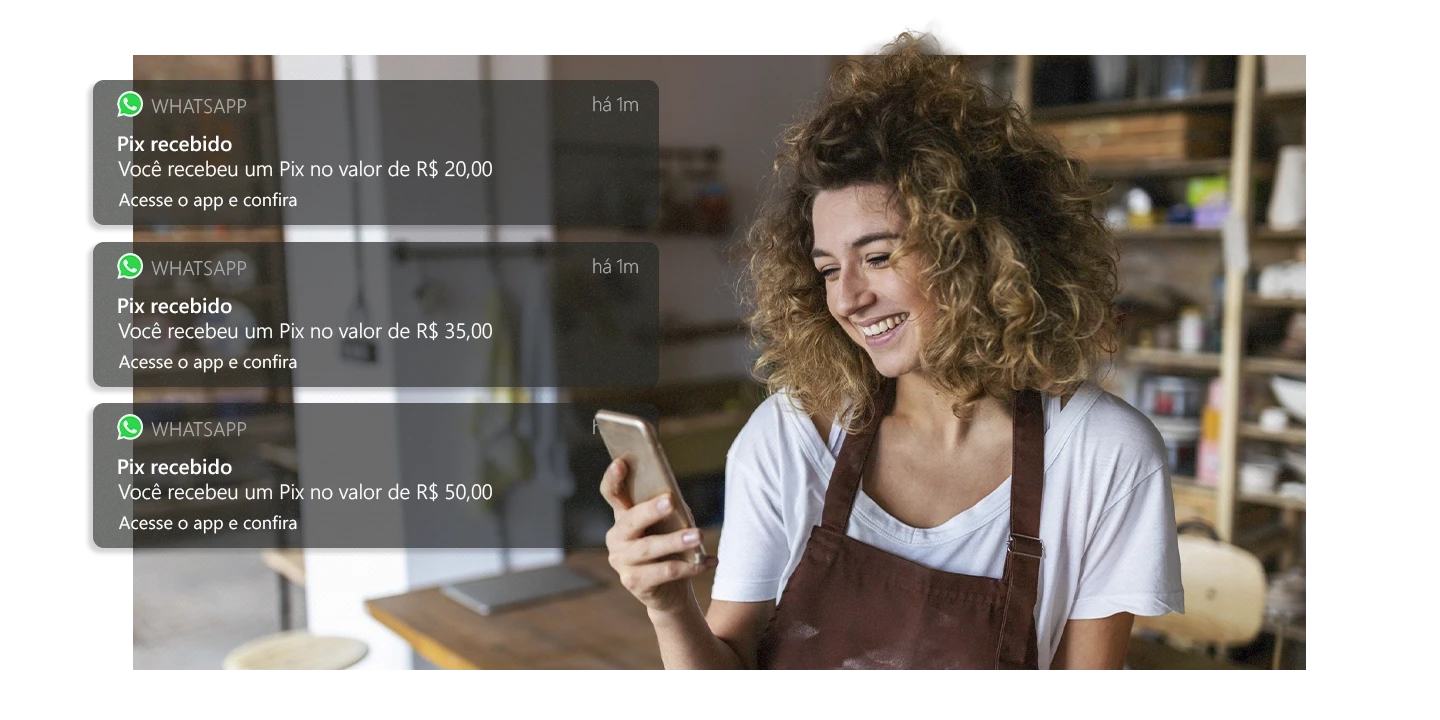

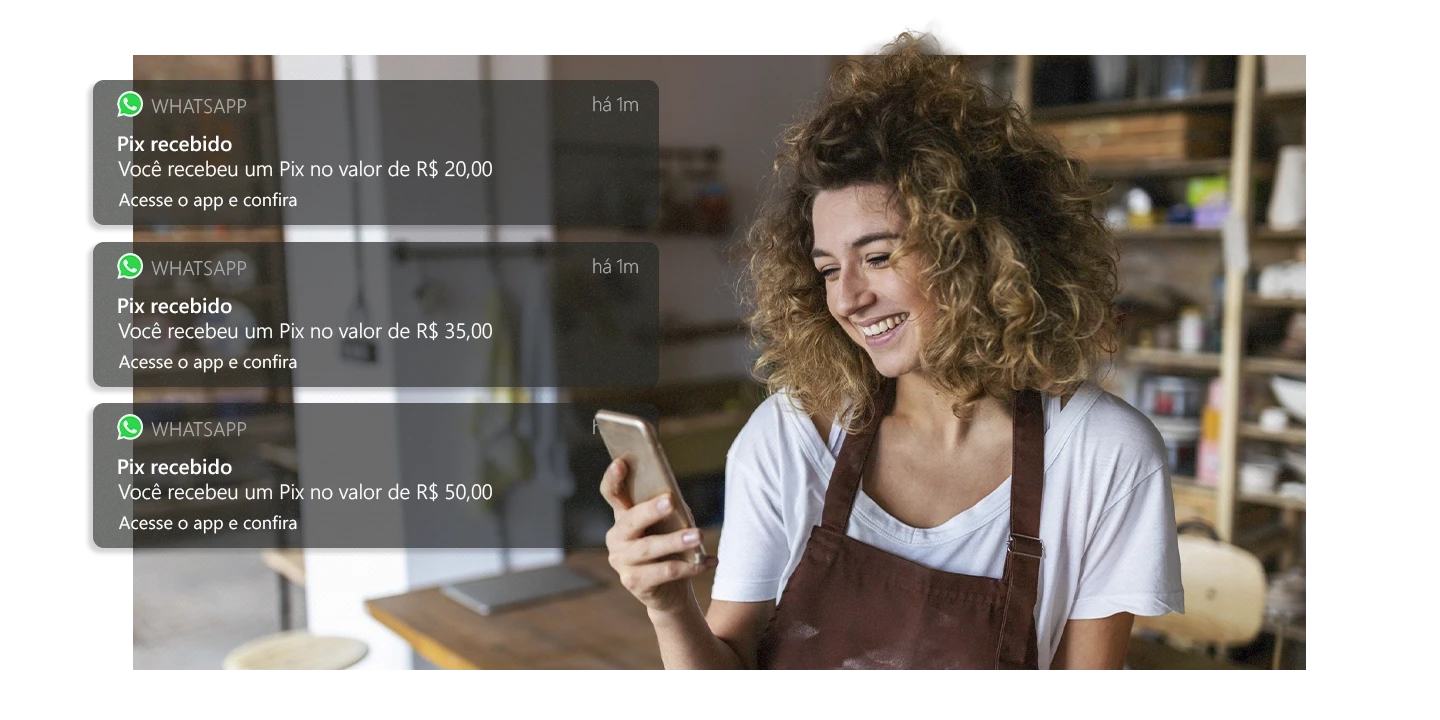

If the union of WhatsApp and Pix is well-received, we will witness a significant advancement in banking transactions, which will become more accessible, efficient, and agile. This way, it will no longer be necessary to leave conversations to make payments, transfers, and requests for payments. The bureaucracy involved in these transactions will decrease, and the cash flow, especially for entrepreneurs, is expected to improve significantly.

Read also: How to increase security when using WhatsApp for financial services?

Advantages of the integration between WhatsApp and Pix

The WhatsApp is already a widely used platform in Brazil, and the integration with Pix offers an intuitive solution. In addition to this benefit, there are other conveniences in the union between these apps.

Accessibility: facilitation in accessing a banking platform, especially for those who are not familiar with this operation;

Security: the encryption and authentication already existing in the messenger will also be applied to transactions, providing greater confidence in making payments;

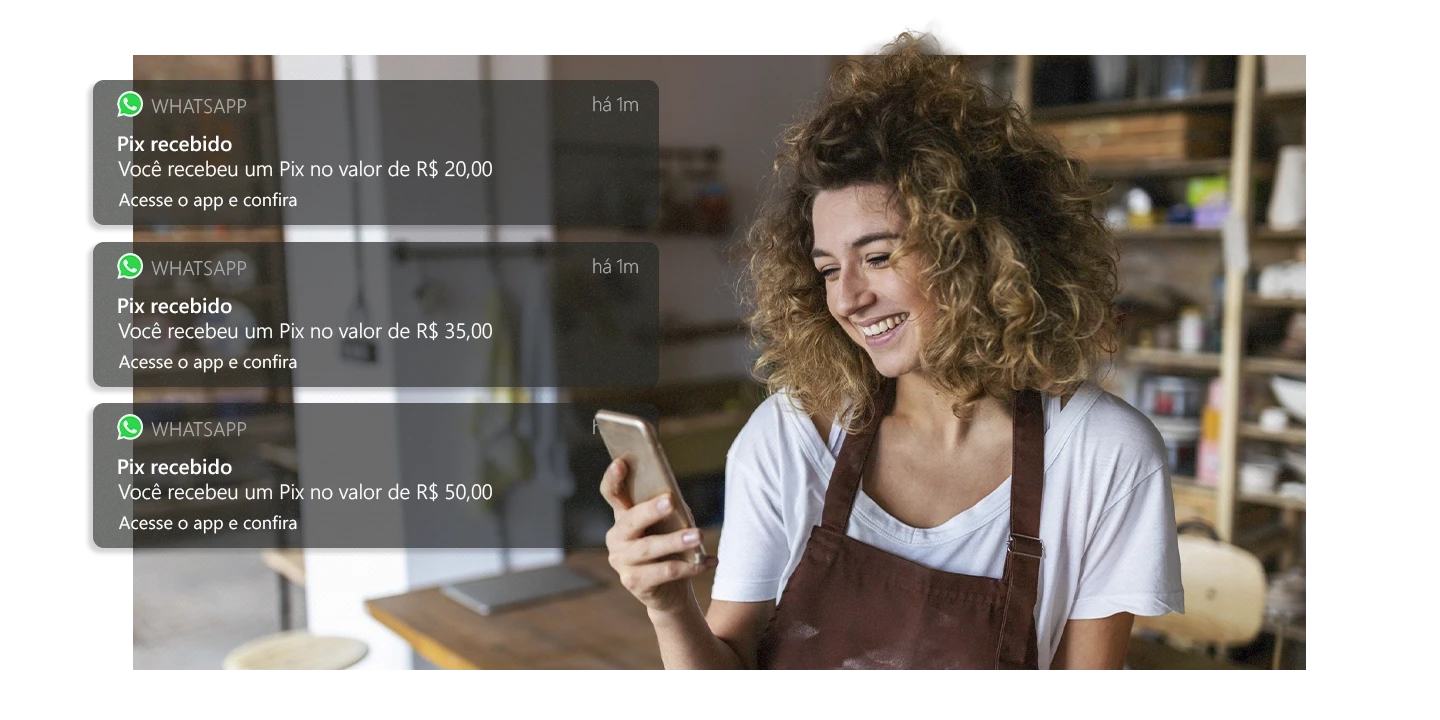

Better experience for businesses: for small and medium entrepreneurs, this is an excellent way to receive payments quickly and without high intermediary costs. In addition, the possibility of charging customers directly on WhatsApp can expedite sales processes and enhance the consumer experience.

Some financial institutions, aware of the potential success of combining Pix with the messaging app, took the lead and also launched their own versions of this integration.

Itaú made available in November 2024, for five thousand account holders, an experimental version of generative artificial intelligence that works based on text and audio messages. The resource will have an initial limit of R$ 200 per day, upon confirmation of transactions by customers. Transactions above this amount are directed to the bank's app.

The monitoring of messages assists in controlling banking transactions

For companies of all sizes that adopt Pix via WhatsApp, with the intention of facilitating banking transactions for customers, supervising these operations is essential to avoid fraud or possible misconduct.

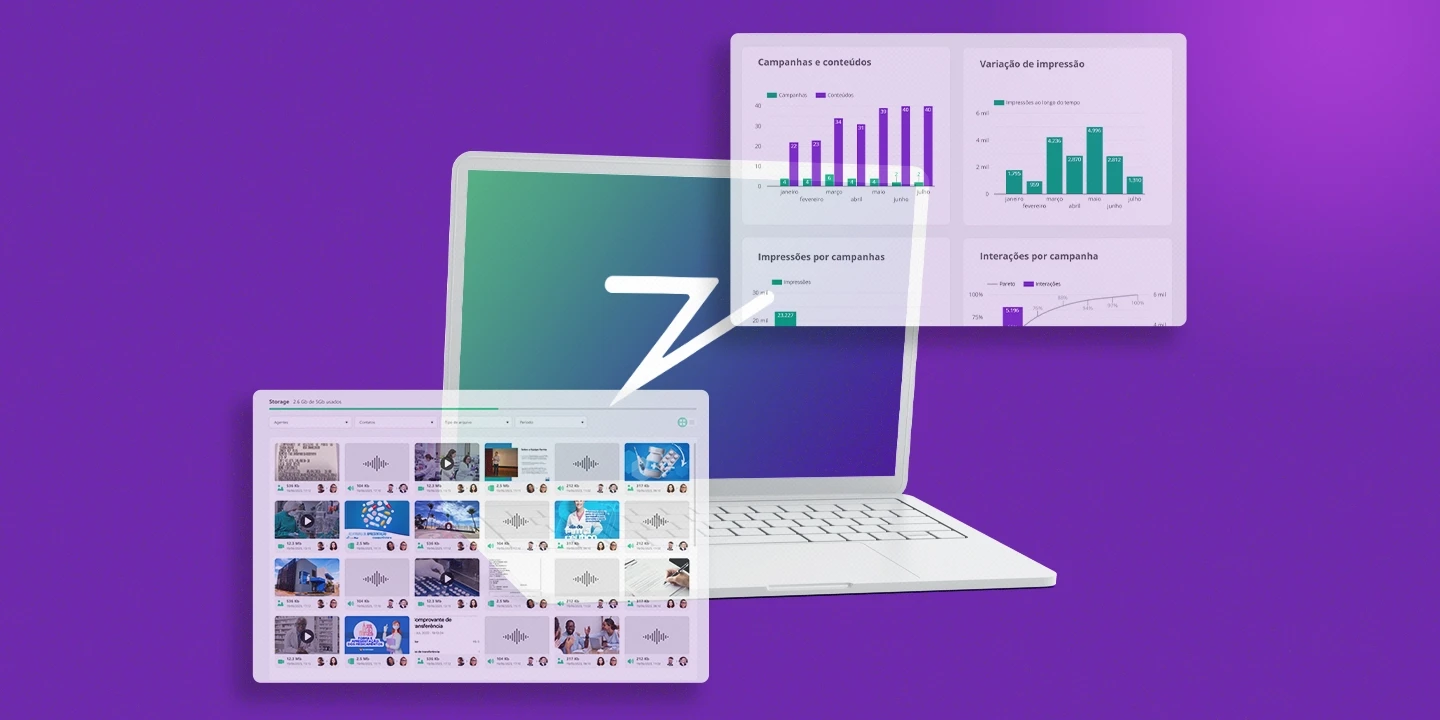

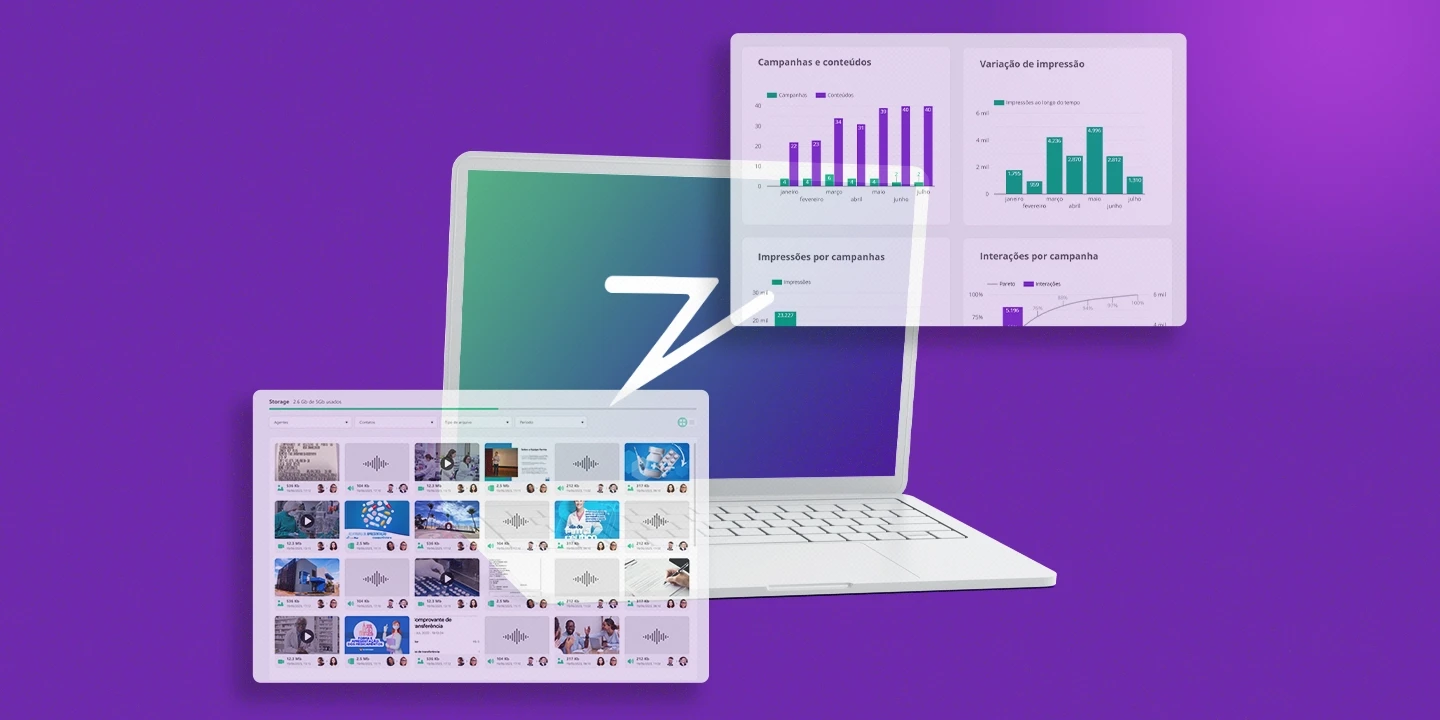

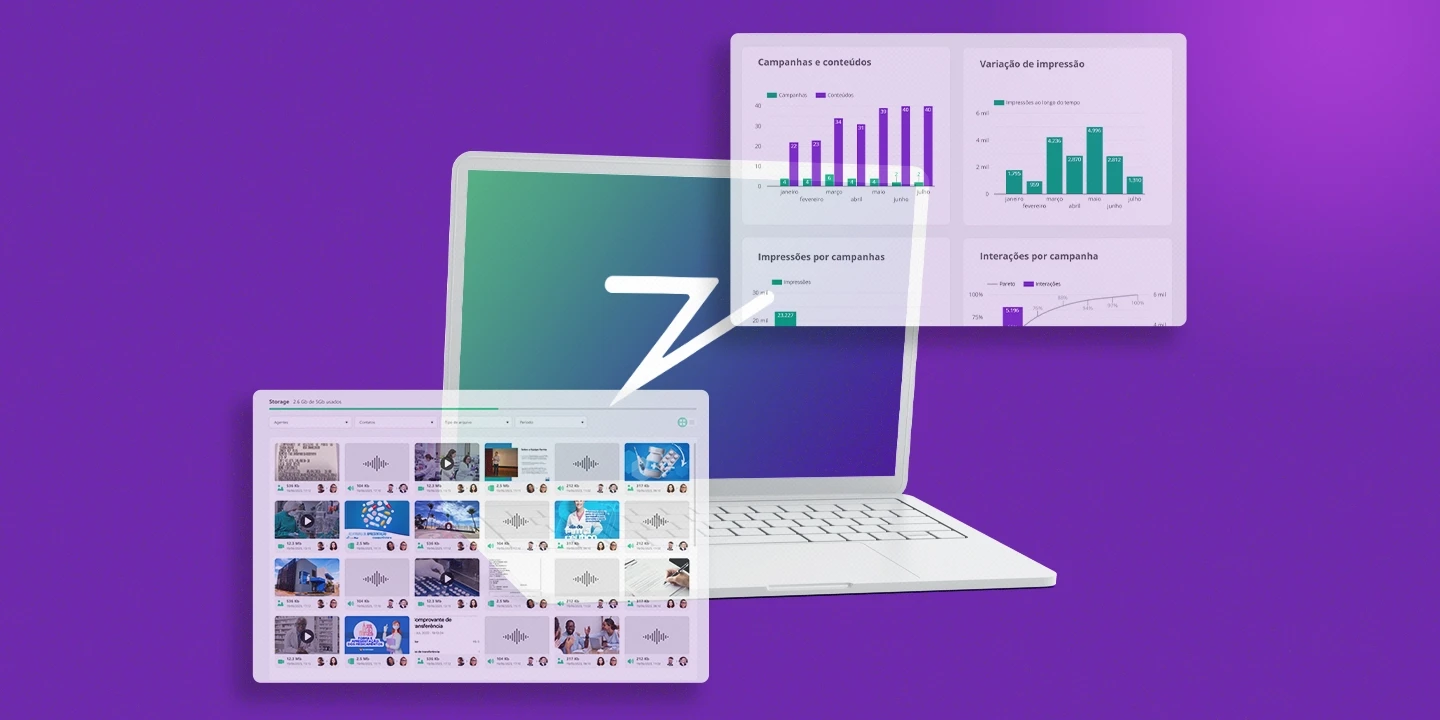

Developed by a Rio de Janeiro startup, the corporate WhatsApp conversation monitoring platform Zapper can be a great ally for companies that want to gain credibility with their customers regarding payments made on the messaging app.

By monitoring the dialogues during the buying and selling processes, between the user and the organization, Zapper identifies keywords that signal payments and receipts, enabling the manager of communication via WhatsApp to check on the negotiation, for example.

Read also: Main questions about monitoring corporate WhatsApp

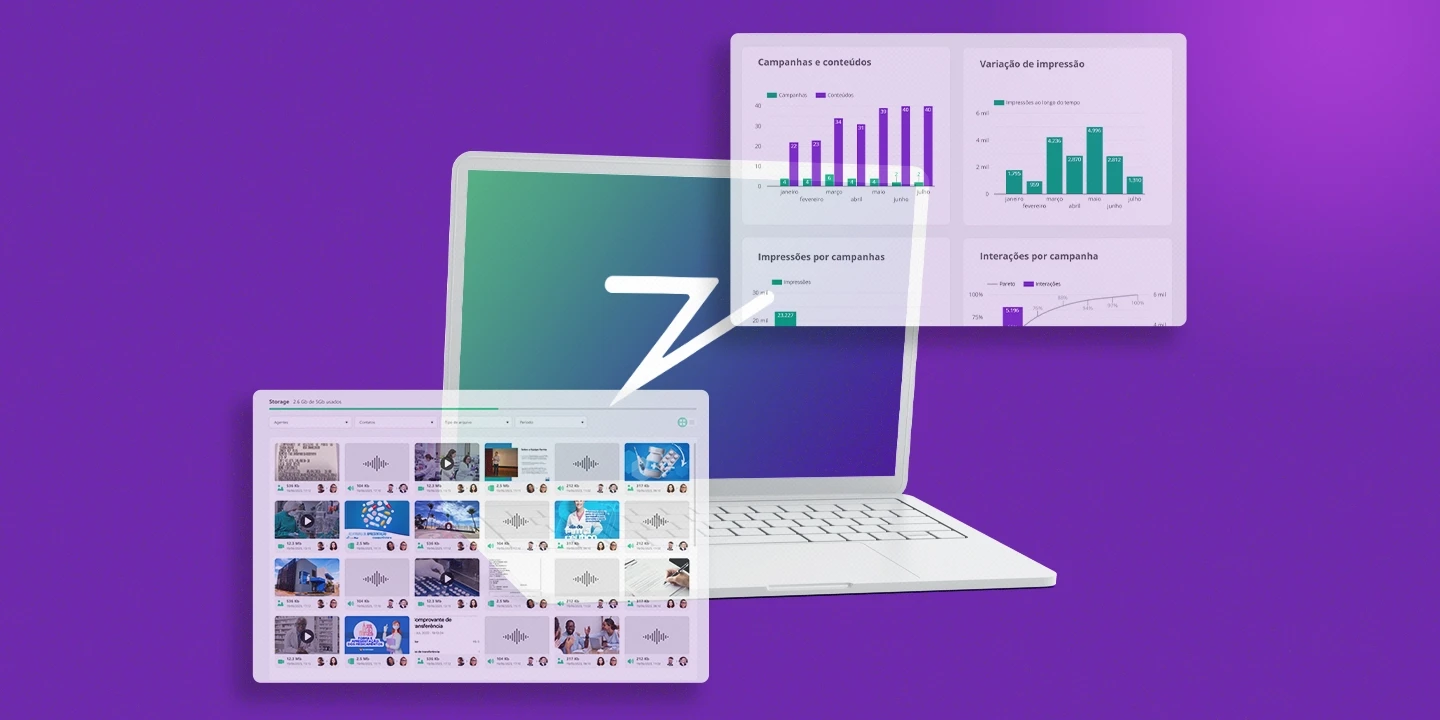

If any violation is detected, the manager is notified immediately, allowing for an immediate intervention in the occurrence. Another feature that ensures the safety of all parties involved in the interaction is that the monitored content is collected and automatically saved in cloud, ensuring confidentiality over sensitive data.

With this information, Zapper also allows the creation of qualitative reports for later analysis by departments, including insights on peak times in service, campaigns with the best results, products with better acceptance, points for improvement in communication, among other factors.

Read also: Turn data into decisions with the help of WhatsApp

The WhatsApp is increasingly present in people's daily lives and is surpassing messaging functions. To get the most out of what it can offer in business, it is essential to have strategies that reinforce user confidence and corporate security. Count on Zapper to promote the best experiences for your customers and the best results for your business.

Click here to schedule a demonstration of the tool.

The WhatsApp never tires of reinventing and evolving its features. On the eve of 2024, Meta announced a new feature to facilitate financial transactions through the app, using a new resource: a shortcut for the Pix key.

This is just the beginning of an integration that may deepen in 2025. The initial idea is to replace debit card payments between individuals within the application. The feature, which will be available by the end of January for all users, will allow the display of Pix keys in the user's profile.

If the union of WhatsApp and Pix is well-received, we will witness a significant advancement in banking transactions, which will become more accessible, efficient, and agile. This way, it will no longer be necessary to leave conversations to make payments, transfers, and requests for payments. The bureaucracy involved in these transactions will decrease, and the cash flow, especially for entrepreneurs, is expected to improve significantly.

Read also: How to increase security when using WhatsApp for financial services?

Advantages of the integration between WhatsApp and Pix

The WhatsApp is already a widely used platform in Brazil, and the integration with Pix offers an intuitive solution. In addition to this benefit, there are other conveniences in the union between these apps.

Accessibility: facilitation in accessing a banking platform, especially for those who are not familiar with this operation;

Security: the encryption and authentication already existing in the messenger will also be applied to transactions, providing greater confidence in making payments;

Better experience for businesses: for small and medium entrepreneurs, this is an excellent way to receive payments quickly and without high intermediary costs. In addition, the possibility of charging customers directly on WhatsApp can expedite sales processes and enhance the consumer experience.

Some financial institutions, aware of the potential success of combining Pix with the messaging app, took the lead and also launched their own versions of this integration.

Itaú made available in November 2024, for five thousand account holders, an experimental version of generative artificial intelligence that works based on text and audio messages. The resource will have an initial limit of R$ 200 per day, upon confirmation of transactions by customers. Transactions above this amount are directed to the bank's app.

The monitoring of messages assists in controlling banking transactions

For companies of all sizes that adopt Pix via WhatsApp, with the intention of facilitating banking transactions for customers, supervising these operations is essential to avoid fraud or possible misconduct.

Developed by a Rio de Janeiro startup, the corporate WhatsApp conversation monitoring platform Zapper can be a great ally for companies that want to gain credibility with their customers regarding payments made on the messaging app.

By monitoring the dialogues during the buying and selling processes, between the user and the organization, Zapper identifies keywords that signal payments and receipts, enabling the manager of communication via WhatsApp to check on the negotiation, for example.

Read also: Main questions about monitoring corporate WhatsApp

If any violation is detected, the manager is notified immediately, allowing for an immediate intervention in the occurrence. Another feature that ensures the safety of all parties involved in the interaction is that the monitored content is collected and automatically saved in cloud, ensuring confidentiality over sensitive data.

With this information, Zapper also allows the creation of qualitative reports for later analysis by departments, including insights on peak times in service, campaigns with the best results, products with better acceptance, points for improvement in communication, among other factors.

Read also: Turn data into decisions with the help of WhatsApp

The WhatsApp is increasingly present in people's daily lives and is surpassing messaging functions. To get the most out of what it can offer in business, it is essential to have strategies that reinforce user confidence and corporate security. Count on Zapper to promote the best experiences for your customers and the best results for your business.

Click here to schedule a demonstration of the tool.

The WhatsApp never tires of reinventing and evolving its features. On the eve of 2024, Meta announced a new feature to facilitate financial transactions through the app, using a new resource: a shortcut for the Pix key.

This is just the beginning of an integration that may deepen in 2025. The initial idea is to replace debit card payments between individuals within the application. The feature, which will be available by the end of January for all users, will allow the display of Pix keys in the user's profile.

If the union of WhatsApp and Pix is well-received, we will witness a significant advancement in banking transactions, which will become more accessible, efficient, and agile. This way, it will no longer be necessary to leave conversations to make payments, transfers, and requests for payments. The bureaucracy involved in these transactions will decrease, and the cash flow, especially for entrepreneurs, is expected to improve significantly.

Read also: How to increase security when using WhatsApp for financial services?

Advantages of the integration between WhatsApp and Pix

The WhatsApp is already a widely used platform in Brazil, and the integration with Pix offers an intuitive solution. In addition to this benefit, there are other conveniences in the union between these apps.

Accessibility: facilitation in accessing a banking platform, especially for those who are not familiar with this operation;

Security: the encryption and authentication already existing in the messenger will also be applied to transactions, providing greater confidence in making payments;

Better experience for businesses: for small and medium entrepreneurs, this is an excellent way to receive payments quickly and without high intermediary costs. In addition, the possibility of charging customers directly on WhatsApp can expedite sales processes and enhance the consumer experience.

Some financial institutions, aware of the potential success of combining Pix with the messaging app, took the lead and also launched their own versions of this integration.

Itaú made available in November 2024, for five thousand account holders, an experimental version of generative artificial intelligence that works based on text and audio messages. The resource will have an initial limit of R$ 200 per day, upon confirmation of transactions by customers. Transactions above this amount are directed to the bank's app.

The monitoring of messages assists in controlling banking transactions

For companies of all sizes that adopt Pix via WhatsApp, with the intention of facilitating banking transactions for customers, supervising these operations is essential to avoid fraud or possible misconduct.

Developed by a Rio de Janeiro startup, the corporate WhatsApp conversation monitoring platform Zapper can be a great ally for companies that want to gain credibility with their customers regarding payments made on the messaging app.

By monitoring the dialogues during the buying and selling processes, between the user and the organization, Zapper identifies keywords that signal payments and receipts, enabling the manager of communication via WhatsApp to check on the negotiation, for example.

Read also: Main questions about monitoring corporate WhatsApp

If any violation is detected, the manager is notified immediately, allowing for an immediate intervention in the occurrence. Another feature that ensures the safety of all parties involved in the interaction is that the monitored content is collected and automatically saved in cloud, ensuring confidentiality over sensitive data.

With this information, Zapper also allows the creation of qualitative reports for later analysis by departments, including insights on peak times in service, campaigns with the best results, products with better acceptance, points for improvement in communication, among other factors.

Read also: Turn data into decisions with the help of WhatsApp

The WhatsApp is increasingly present in people's daily lives and is surpassing messaging functions. To get the most out of what it can offer in business, it is essential to have strategies that reinforce user confidence and corporate security. Count on Zapper to promote the best experiences for your customers and the best results for your business.

Click here to schedule a demonstration of the tool.

The WhatsApp never tires of reinventing and evolving its features. On the eve of 2024, Meta announced a new feature to facilitate financial transactions through the app, using a new resource: a shortcut for the Pix key.

This is just the beginning of an integration that may deepen in 2025. The initial idea is to replace debit card payments between individuals within the application. The feature, which will be available by the end of January for all users, will allow the display of Pix keys in the user's profile.

If the union of WhatsApp and Pix is well-received, we will witness a significant advancement in banking transactions, which will become more accessible, efficient, and agile. This way, it will no longer be necessary to leave conversations to make payments, transfers, and requests for payments. The bureaucracy involved in these transactions will decrease, and the cash flow, especially for entrepreneurs, is expected to improve significantly.

Read also: How to increase security when using WhatsApp for financial services?

Advantages of the integration between WhatsApp and Pix

The WhatsApp is already a widely used platform in Brazil, and the integration with Pix offers an intuitive solution. In addition to this benefit, there are other conveniences in the union between these apps.

Accessibility: facilitation in accessing a banking platform, especially for those who are not familiar with this operation;

Security: the encryption and authentication already existing in the messenger will also be applied to transactions, providing greater confidence in making payments;

Better experience for businesses: for small and medium entrepreneurs, this is an excellent way to receive payments quickly and without high intermediary costs. In addition, the possibility of charging customers directly on WhatsApp can expedite sales processes and enhance the consumer experience.

Some financial institutions, aware of the potential success of combining Pix with the messaging app, took the lead and also launched their own versions of this integration.

Itaú made available in November 2024, for five thousand account holders, an experimental version of generative artificial intelligence that works based on text and audio messages. The resource will have an initial limit of R$ 200 per day, upon confirmation of transactions by customers. Transactions above this amount are directed to the bank's app.

The monitoring of messages assists in controlling banking transactions

For companies of all sizes that adopt Pix via WhatsApp, with the intention of facilitating banking transactions for customers, supervising these operations is essential to avoid fraud or possible misconduct.

Developed by a Rio de Janeiro startup, the corporate WhatsApp conversation monitoring platform Zapper can be a great ally for companies that want to gain credibility with their customers regarding payments made on the messaging app.

By monitoring the dialogues during the buying and selling processes, between the user and the organization, Zapper identifies keywords that signal payments and receipts, enabling the manager of communication via WhatsApp to check on the negotiation, for example.

Read also: Main questions about monitoring corporate WhatsApp

If any violation is detected, the manager is notified immediately, allowing for an immediate intervention in the occurrence. Another feature that ensures the safety of all parties involved in the interaction is that the monitored content is collected and automatically saved in cloud, ensuring confidentiality over sensitive data.

With this information, Zapper also allows the creation of qualitative reports for later analysis by departments, including insights on peak times in service, campaigns with the best results, products with better acceptance, points for improvement in communication, among other factors.

Read also: Turn data into decisions with the help of WhatsApp

The WhatsApp is increasingly present in people's daily lives and is surpassing messaging functions. To get the most out of what it can offer in business, it is essential to have strategies that reinforce user confidence and corporate security. Count on Zapper to promote the best experiences for your customers and the best results for your business.

Click here to schedule a demonstration of the tool.

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Claudia Campanhã

Journalist, broadcaster, and postgraduate in social media from FAAP

Share:

Share:

Share:

Share: